Categories

APIs (2)

APIs (2) Bulk SMS (16)

Bulk SMS (16) Click to Call (4)

Click to Call (4) Cloud Call Center (10)

Cloud Call Center (10) Whats AppBusiness API (3)

Whats AppBusiness API (3) Cloud Telephony (23)

Cloud Telephony (23) DLT (4)

DLT (4) IVR (5)

IVR (5) Missed Call (3)

Missed Call (3) Mobile Cloud Call Center (2)

Mobile Cloud Call Center (2) Outbound Calling Service (3)

Outbound Calling Service (3) Political Campaigns (11)

Political Campaigns (11) Toll Free Number (5)

Toll Free Number (5) Voice Broadcasting Service (11)

Voice Broadcasting Service (11) Zoho CRM (1)

Zoho CRM (1) WhatsApp (17)

WhatsApp (17) RCS SMS(5)

RCS SMS(5) LMS(2)

LMS(2) 140 and 1600 Series(4)

140 and 1600 Series(4)

04

Oct

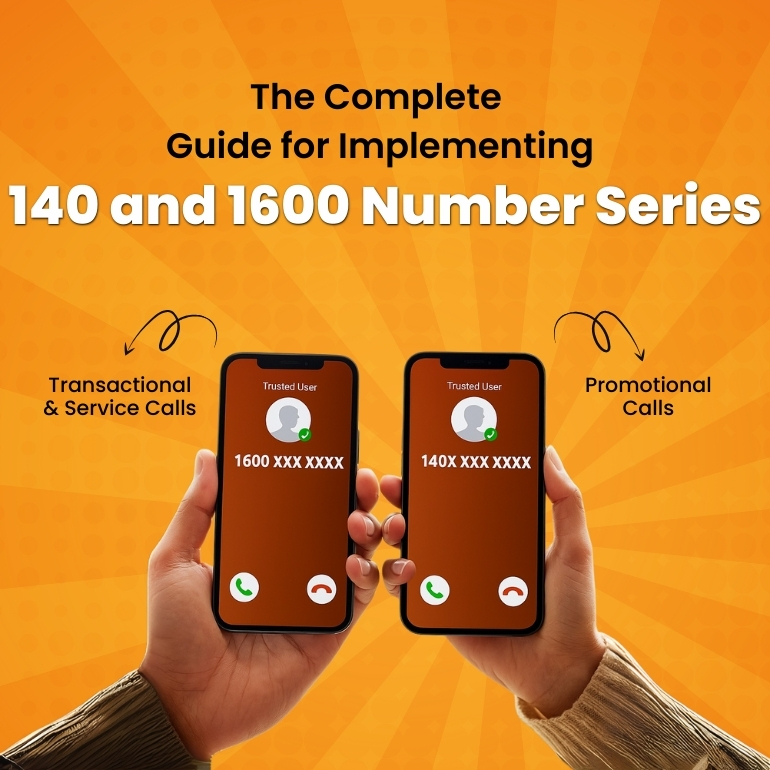

The Complete Guide for Implementing 140 and 1600 Number Series

TRAI mandated new guidelines for voice calls to create a safe and spam-free communication infrastructure in India. To achieve this, TRAI has mandated the use of specific number series for business calls based on their nature. The new TCCPR guidelines mandate the use of 140 series for all promotional and marketing calls and use of 1600 series for all transactional and service-related calls by regulated entities.

This structured approach aims to establish a secure and trackable mechanism to curb spam, reduce fraudulent activities, and help mobile users easily differentiate between legitimate and unsolicited calls. For more details on how your business can adopt the 140 and 1600 series and stay compliant, read this detailed blog or connect with Go2Market for seamless implementation support.

Who Can Procure the 140 and 1600 Series?

140 Series (Promotional Calls) – For businesses, enterprises, and telemarketers running promotional campaigns. Any marketing or outreach activity must be routed through 140 number series, and entities must register on the DLT platform for compliance.

1600 Series (Transactional Calls) – For regulated entities such as banks, NBFCs, insurance companies, mutual funds, pension funds, and stockbrokers, essentially those falling under RBI, SEBI, IRDAI, and PFRDA regulations. This ensures that sensitive communication like OTPs, alerts, payment reminders, and policy updates are delivered securely.

How the 140 and 1600 Series is being Implemented across Industries

1. Banking & NBFCs – Banks and NBFCs are transitioning all transactional voice calls via 1600 series (e.g., OTP verification, loan reminders, EMI alerts). This shift helps reassure customers that they are dealing with genuine institutions, not fraudsters pretending to be bank officials.

2. Insurance Sector – Insurance providers are adopting the 1600 series for policy renewals, premium reminders, and claim status updates. This prevents spammers from misleading customers with fake policy expiry calls.

3. Stockbroking & Investment Firms – Entities regulated by SEBI are now using the 1600 series to send transactional updates like trade confirmations, portfolio alerts, and settlement notifications. This creates trust and helps users avoid fraudulent investment calls.

4. Enterprises & Other Businesses – Non-regulated businesses (like e-commerce, hospitality, and healthcare) must use the 140 series for marketing calls (discount offers, promotions, surveys). They are barred from using personal 10-digit numbers for outreach, which creates a cleaner communication environment for customers.

How Businesses Are Adopting the Change

Switching to Licensed Providers – Businesses are working with VNOs and trusted service providers like Go2Market to procure 140/1600 series numbers.

Training Teams – Call center and telemarketing teams are being educated to follow compliant number series for outreach.

CRM & Call Center Integration – Enterprises are integrating the new series into their existing IVR and cloud call center solutions for smooth implementation.

Customer Awareness – BFSI players are informing customers through SMS, emails, and websites that genuine calls will only come from the 1600 series.

The Role of DLT Registration for 140 and 1600 Series

Both 140 and 1600 series calls require businesses to be registered on the Distributed Ledger Technology (DLT) platform. This ensures every business is:

Verified as a Principal Entity (PE).

Linked to a Telemarketer (TM) or vendor for routing calls.

Compliant with TRAI templates for voice communication.

For promotional calls via 140 series, voice templates must also be registered and approved on the DLT system, ensuring transparency and preventing misuse.

How Go2Market Helps with the Procurement & Implementation of 140 and 1600 Series

As a VNO-licensed cloud telephony provider, Go2Market simplifies the transition by offering:

DLT & PE registration support – Helping businesses with compliance and approvals.

Seamless number procurement & Implementation – Quick setup of 140 & 1600 series.

Robust infrastructure – Secure systems for both promotional and transactional calls.

Cloud call center integration – Faster adoption for businesses already using Go2Market’s hosted IVR or call center solutions.

End-to-end compliance management – From documentation to implementation, ensuring your communication is fully aligned with TRAI guidelines.

Impact of this Change on the BFSI Industry

The BFSI sector is most impacted by these changes because of the sensitive nature of its communication. Customers will now:

Instantly recognize legitimate calls from their bank or insurer.

Feel more confident engaging with calls from the 1600 series.

Face fewer risks of financial fraud through fake calls.

For BFSI institutions, these changes mean not only compliance but also improved customer trust, stronger brand credibility, and reduced liability in case of scams.

Conclusion,

In conclusion, we can say that the launch of the 140 and 1600 series is a transformative step in building a safer, spam-free communication ecosystem in India. For businesses, it is not just about regulatory compliance, it is about protecting customer trust, reducing fraud risks, and ensuring secure communication channels.

As more customers become aware of these number series, adoption will accelerate, making the entire ecosystem more reliable. Businesses that act early will not only stay compliant but also gain a competitive edge by being seen as secure and trustworthy. To know more about these guidelines or to implement the 140 and 1600 series for your business, connect with Go2Market today at 85 95 08 08 08 or visit us at www.go2market.in

Follow Us